Emmvee Photovoltaic Power IPO 2025: A Comprehensive Guide for Investors

The Indian renewable energy sector is buzzing with the upcoming Initial Public Offering (IPO) of Emmvee Photovoltaic Power Limited. As a dominant player in solar module manufacturing, Emmvee's move to go public is one of the most anticipated market events of late 2025. This deep-dive analysis provides everything you need to know about the Emmvee Photovoltaic Power IPO, from key dates and financials to its long-term growth prospects.

Scheduled for November 2025, this IPO represents a significant moment for India's green energy ambitions and offers investors a chance to tap into a rapidly expanding market.

Key Highlights of the Emmvee Photovoltaic Power IPO

The Emmvee Photovoltaic Power IPO is a mix of fresh capital and an offer for sale by existing promoters. The public issue is set to open on November 11, 2025, and will close on November 13, 2025. The company has set a price band of ₹206 to ₹217 per equity share.

With a lot size of 69 shares, the minimum investment required for retail investors is ₹14,973. The total issue size is a substantial ₹2,900 crores, comprising a fresh issue of ₹2,143.86 crores and an offer for sale (OFS) of ₹756.14 crores by promoters. The shares are expected to be listed on both the BSE and NSE around November 18, 2025.

Company Overview: A Solar Powerhouse

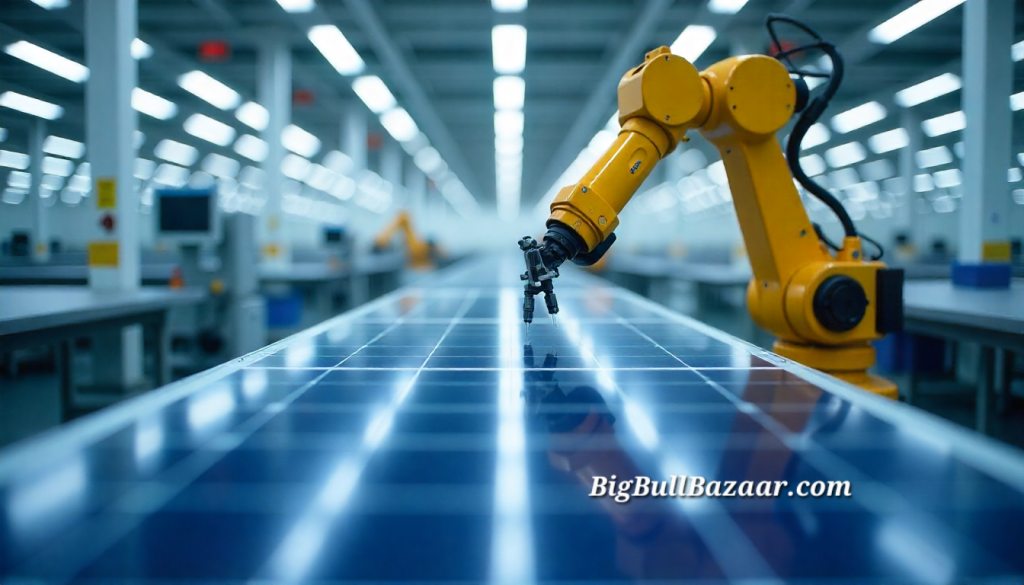

Established in 2007 and based in Bengaluru, Emmvee Photovoltaic Power Limited is a leading integrated manufacturer of solar photovoltaic modules and solar cells. It is part of the broader Emmvee Group, which has been a pioneer in the solar energy domain since the 1990s.

The company has cemented its position as the second-largest pure-play integrated solar PV module and solar cell manufacturer in India. This "integrated" approach, where it controls both cell and module production, gives it greater control over quality, cost, and supply chain efficiency.

Core Business Strengths and Market Position

Emmvee's appeal to investors is rooted in several formidable strengths:

1. Significant Production Capacity: The company boasts an impressive solar PV module production capacity of 7.80 GW and a solar cell capacity of 2.94 GW as of mid-2025. This scale allows it to compete effectively for large-scale projects.

2. Technological Leadership: Emmvee was an early adopter in India of the high-efficiency TOPCon (Tunnel Oxide Passivated Contact) cell technology. TOPCon modules offer better performance and energy yield compared to conventional panels, positioning Emmvee at the forefront of solar innovation.

3. Robust Order Book: A strong and credible order book is a key indicator of future revenue. As of May 31, 2025, Emmvee had a formidable order book of 5.26 GW, providing clear visibility into its future earnings and growth trajectory.

4. Diverse and Extensive Clientele: The company serves a wide base of over 500 customers, including major independent power producers, commercial and industrial entities, and EPC service providers. This diversity reduces reliance on any single customer or segment.

Financial Performance: A Story of Explosive Growth

A closer look at Emmvee's financials reveals a company on a high-growth path. The numbers from the last three fiscal years tell a compelling story.

In the fiscal year ending March 2023, the company reported a total revenue of ₹724.07 crores with a profit after tax (PAT) of ₹22.65 crores. The following year, FY 2024, saw revenue jump to ₹1,255.38 crores, with PAT growing to ₹82.27 crores.

The most impressive growth, however, was witnessed in FY 2025. The company's revenue more than doubled to ₹2,360.33 crores, while its profit after tax skyrocketed to ₹369.01 crores. This explosive growth underscores the company's scaling operations and the booming demand for its products.

IPO Objectives: What is the Fundraise For?

The capital raised through the fresh issue portion of the IPO will be strategically utilized. A significant portion is earmarked for the repayment and prepayment of outstanding borrowings for the company and its material subsidiary. This will strengthen the company's balance sheet by reducing debt and interest costs. The remaining funds will be used for general corporate purposes to support ongoing business needs and growth initiatives.

The Offer for Sale (OFS) component will allow promoters Manjunatha Donthi Venkatarathnaiah and Shubha Manjunatha Donthi to partially divest their holdings.

Should You Invest in the Emmvee Photovoltaic Power IPO?

The Positives:

· Sector Tailwinds: The company operates in the solar energy sector, which is a core focus of the Indian government's renewable energy push, benefiting from strong policy support.

· Strong Financials: The recent financial performance shows remarkable revenue and profit growth.

· Market Leadership: Its position as a top-tier integrated manufacturer provides a competitive edge.

· Healthy Order Book: The 5.26 GW order book ensures predictable future revenue streams.

Points to Consider:

· Valuation: Investors must assess whether the IPO pricing, set at the P/E ratio derived from the price band, is justified given the company's prospects and industry benchmarks.

· Execution Risk: The ability to efficiently utilize capacities and fulfill the large order book will be critical.

· Market Volatility: Like all IPOs, the listing and subsequent performance can be influenced by broader stock market conditions.

Final Verdict

The Emmvee Photovoltaic Power IPO presents a compelling opportunity to invest in a leading player within India's high-growth solar industry. With strong fundamentals, technological prowess, and a clear use of proceeds, it is poised to attract significant attention from institutional and retail investors alike.

As with any investment, it is crucial to read the Red Herring Prospectus (RHP) carefully and consider your own financial goals and risk appetite before applying.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult with a qualified financial advisor before making any investment decisions.

Leave a Reply