Nifty soars to a 52-week high! Get our in-depth analysis of last week's market drivers and expert predictions for Monday and the upcoming week. Key levels for Nifty & Bank Nifty inside.

Indian Stock Market Weekly Outlook: Nifty at 52-Week High – What’s Next?

The Indian stock market wrapped up the previous week on a powerful note, setting the stage for an intriguing week ahead. The benchmark Nifty 50 index scaled a fresh 52-week peak, and the Bank Nifty catapulted to a record high, leaving investors buzzing with anticipation.

In this comprehensive weekly outlook, we’ll dissect the key drivers behind last week’s rally and provide expert-backed predictions to help you navigate the trading days ahead.

Last Week in Review: A Bullish Stampede

The trading week was characterized by robust buying, particularly in key sectors, underscoring the underlying strength of the market.

- Benchmarks at Highs: The Nifty 50 index surged 0.49% on Friday, closing at 25,709.85, after touching a intraday high of 25,781.50. Similarly, the Sensex gained 0.58% to settle at 83,952.19.·

- Sectoral Superstars: The rally was broad-based. The Nifty FMCG index led the charge, jumping 1.37%, as investors bet on steady consumption. The Nifty Bank index was the star performer, breaking its previous record to hit a new all-time high of 57,830.20.

- The Driving Forces: The bullish sentiment was fueled by a combination of in-line quarterly results from major companies and resilient domestic economic data. Despite swirling global uncertainties, the "India story" continued to attract investors.

Market Prediction for Monday & The Upcoming Week

The technical setup and market sentiment point towards a continuation of the bullish trend, with a firm "buy on dips" strategy being advocated by analysts.

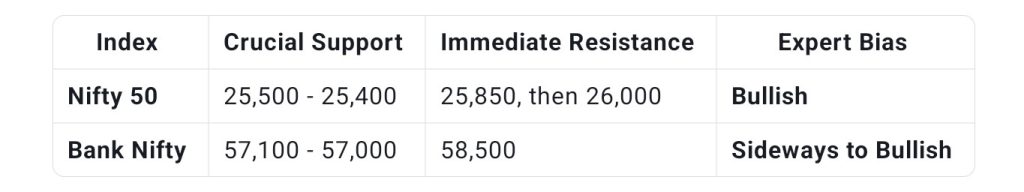

Here’s a quick snapshot of the key levels to watch:

A Deeper Dive into the Outlook:

- Nifty 50 Technical Breakout: The index has delivered a decisive breakout above a key down-sloping trend line around the 25,400-25,500 zone. This is a strongly bullish technical pattern, suggesting that the index is now poised to make a run towards its all-time high of 26,277. Any dip towards the 25,500 support level is likely to be seen as a buying opportunity.·

- Bank Nifty's Record Run: Having already achieved a new milestone, the Bank Nifty's momentum is expected to continue. The immediate target lies around the 58,500 mark, with stronger resistance near 59,000.·

- Earnings in the Driver's Seat: The market's trajectory this week will be heavily influenced by the Q2 FY26 earnings of heavyweight giants like Reliance Industries, HDFC Bank, and ICICI Bank. Their results could single-handedly dictate the market's direction.

Key Factors That Will Move the Market This Week

Stay informed on these critical domestic and global triggers:

Domestic Catalysts:

- 1. Q2 FY26 Earnings Season: This remains the primary focus. Performance of banking, IT, and auto sectors will be closely scrutinized.

- 2. Festive Cheer: With the Diwali season around the corner, sectors like Auto, FMCG, and Consumer Durables could see a sentiment boost due to expected demand growth.

Global Cues to Monitor:

- 1. Geopolitical Tensions & Trade Wars: The market remains on edge about global events. Last week's reminder came when former US President Donald Trump's threats of higher tariffs on China caused ripples across global markets.

- 2. US Economic Policy: The ongoing situation regarding the US government and its potential impact on economic data releases and, consequently, the Federal Reserve's interest rate path, will be a key monitorable.

Conclusion: Tread Optimistically, But Stay Alert

The short-term outlook for the Indian stock market is undoubtedly positive, backed by strong technical breakouts and resilient domestic fundamentals. The strategy of "buying on dips" seems prudent for traders.

However, it is crucial to remember that markets are inherently volatile. While the path of least resistance appears to be upward, external shocks or disappointing earnings could trigger corrections.

Disclaimer: This article is for educational and informational purposes only. It is not a recommendation to buy or sell any securities. Market conditions can change rapidly. Please consult with a qualified financial advisor before making any investment decisions.

Leave a Reply